Navigating the Choice: Comparing PPO vs. HDHP Plans for a Family with a Chronic Condition

For a family managing a chronic condition, the annual decision between a Preferred Provider Organization (PPO) and a High-Deductible Health Plan (HDHP) is far more than a simple cost comparison. It is a critical choice that directly impacts access to necessary care, financial stability, and peace of mind.

While HDHPs are often hailed for their low monthly premiums and tax-advantaged Health Savings Account (HSA), the financial realities of ongoing, high-frequency medical needs typically tip the scales in favor of a traditional PPO.

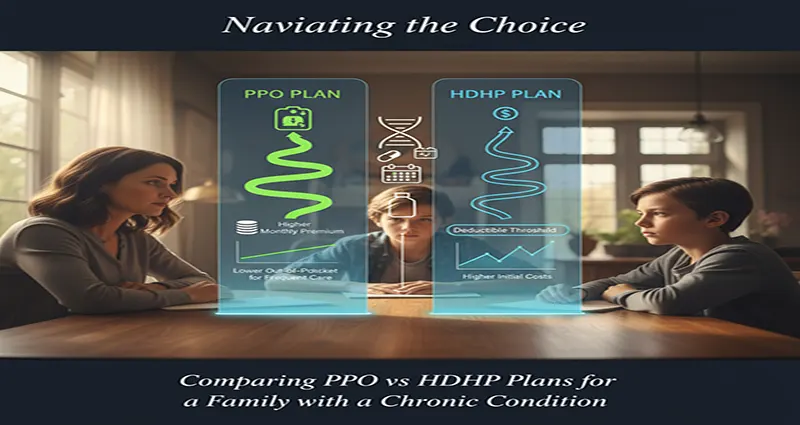

The Core Difference: Premium vs. Deductible

Understanding the fundamental trade-off is the starting point for any family with predictable, high healthcare usage.

| Feature | Preferred Provider Organization (PPO) | High-Deductible Health Plan (HDHP) |

| Monthly Premium | Higher | Lower |

| Annual Deductible | Lower | Higher (Meets an IRS minimum) |

| Access to HSA | Typically No | Yes (HSA-Eligible) |

| Cost of Service | Copayments or Coinsurance start sooner (often before deductible is met) | Full cost paid by the |